Better Megacap Stock: Nvidia vs. Microsoft

Let's face it: 2024 has been all about the megacaps. Nvidia (NASDAQ: NVDA) is up 147% year to date; Meta Platforms is up 44%; Alphabet is up 33%.

Moreover, Nvidia, Apple, Microsoft, Amazon, Alphabet, and Meta Platforms now boast a combined market cap of $15.6 trillion. That's roughly equivalent to the size of the Eurozone economy, which has an annual gross domestic product of $15.4 billion, according to the latest estimates from the World Bank.

So, let's compare two of the best megacaps, Nvidia and Microsoft (NASDAQ: MSFT), to see which is better positioned to rule the second half of 2024 -- and beyond.

Nvidia

No company has experienced a more remarkable growth in its market cap over the past two years than Nvidia. The semiconductor giant has added a staggering $2.7 trillion in value, catapulting it to the position of the most valuable company on Earth, if only briefly.

Its rise is almost entirely thanks to the surge in demand for artificial intelligence (AI) and the hardware behind it. Nvidia designs graphics processing units (GPUs). These powerful devices are often linked together by the thousands -- even hundreds of thousands -- within data centers to help train the latest and greatest AI models.

While there are other companies in the GPU design space, Nvidia enjoys several key competitive advantages. The trust and familiarity AI developers have with Nvidia's GPUs and its software make it challenging for them to switch to another supplier. Moreover, Nvidia's extensive experience in GPU design prior to the AI boom gives it a unique edge over its competitors.

Microsoft

Despite the attention garnered by Nvidia's rapid ascent, it's important not to overlook Microsoft's impressive stock performance. The company once again holds the title of the most valuable company on Earth, a position it regained after briefly being overtaken by Nvidia. To maintain this lead, Microsoft is demonstrating its adaptability to the evolving tech landscape, particularly the AI revolution.

On that front, Microsoft has already begun integrating AI into its signature software applications. It now offers a generative AI assistant through its Microsoft Copilot add-on, which can analyze data, respond to queries, create images, and generate code.

What's more, Microsoft diverse business segments provide a layer of protection, should the AI revolution falter. The company has a massive cloud services unit and a successful gaming division among various other business segments.

Which stock is a better buy in the second half of 2024?

Simply put, both Nvidia and Microsoft are outstanding companies. They generate billions in revenue, profits, and free cash flow. They're also led by some of the top CEOs on the planet: Satya Nadella at Microsoft and Jensen Huang at Nvidia.

However, there are differences to evaluate.

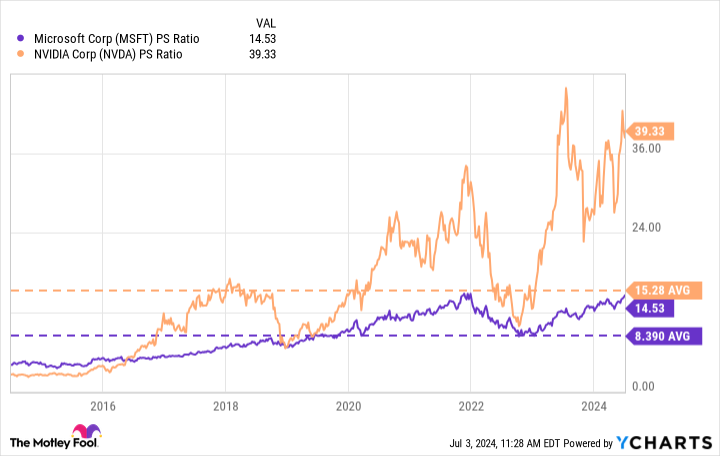

For one, Nvidia's valuation is approaching record highs. Its price-to-sales (P/S) ratio is now 39x -- more than double its 10-year average of 15x.

Meanwhile, Microsoft's P/S ratio is also historically high at 14x. However, that value is less than half of Nvidia's on an absolute basis.

In other words, both stocks are historically expensive, but Nvidia is far more costly in a head-to-head comparison.

At any rate, the rapid growth of the GPU market is what investors are counting on to bring Nvidia's valuation down. And while those growth estimates are impressive (analysts expect Nvidia's sales to rise 98% over last year), any signs of slowing growth could lead to a sharp sell-off in Nvidia shares.

In conclusion, I prefer Microsoft, given the stock's more reasonable valuation at current levels. That said, long-term Nvidia investors shouldn't bail on the stock now. Rather, they should remember that one of the keys to successful buy-and-hold investing is to let winners run.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better Megacap Stock: Nvidia vs. Microsoft was originally published by The Motley Fool